Rents on the office market are at EUR 18.5/sq. m/ month in prime buildings, among the lowest in ECE. Compared to Romania, Warsaw (Poland) registers the most expensive market in the region with a rent of nearly EUR 23.5 / sq. m/month, in Budapest (Hungary) the maximum rent reaches EUR 21 /sq. m/month, while in Prague (the Czech Republic) rent reach EUR 19.5/sq. m / month.

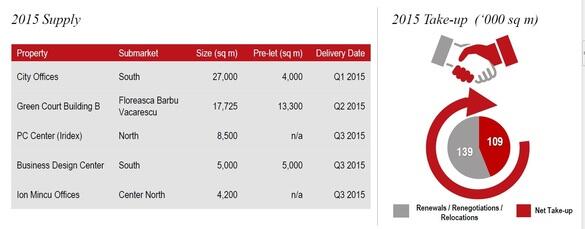

On the office market, the new deliveries have totalized last year 62,425 sq. m, half of the level registered in 2014, and the estimations for this year include the completion of more than 360,000 sq. m, the second largest value ever registered in Bucharest (after 2009, when 375,000 sq. m were delivered).

Largest new office area will be built in Floreasca-Barbu Văcărescu and Dimitrie Pompeiu – more than half of the total scheduled for this year.

The total stock reached in the end of last year 2.3 million square metres, so this year will reach 2.65 million sq. m. Considering the available labour, compared to other CEE capitals, Bucharest is still under developed regarding the office buildings stock.

In Warsaw, there are more than 4.5 million sq. m, while Prague and Budapest reached 3.2-3.3 million sq. m.

On the background of a low deliveries volume and of a sustainable net take-up over the last 2-3 years, the vacancy rate was lowered to 13.3 pct. in 2015. The vacancy is though different according to the zone, with 3.7 pct. in Dimitrie Pompeiu and 33.7 pct in Pipera Nord (Voluntari).

The vacancy rate in Bucharest is similar to the average of the markets in the region, with Prague having nearly 14.5 pct. and Budapest and Warsaw nearly 12 pct.

The gross office take-up (expansions, renegotiations, relocations, new leases) totalized 248,800 sq. m, 15.4 pct below the level of 2014. Nearly 110,000 sq. m of the gross take-up was represented by new requests, including expansions and new leases, with 9.3 pct. drop compared to 2014. Considering an average of 10 sq. m office space allotted by a company to an employee, the contracts signed in 2015 created nearly 10,000 new working places.

Considering the zones, the rents vary between EUR 16 and EUR 18.5 / sq.m/month in Victoriei Square, EUR15-16 euro/sq. m/month in Floreasca –Barbu Văcărescu, EUR12-14 euro/sq. m/month in Dimitrie Pompeiu, reaching EUR 9-10/sq. m/month in Pipera Nord, where the vacancy rate is very high. The gross take-up of industrial spaces (including relocations, renegotiations and extensions) will be similar this year to the take-up registered in 2014 and 2015, mainly from logistics companies in Bucharest and automotive companies in the rest of Romania, the level of rents being constant at EUR 3.5-4 / sq. m/ month.

Last year, the new industrial spaces deliveries totalized nearly 160,000 sq. m, with 67.5 pct above the level in 2014. For this year, the developers have scheduled for completion projects totalizing 240,000 sq. m, most of them being build to suit, 40 pct. more than in 2015, shows data of JLL.

Total stock of modern spaces reached in the end of last year 2.1 million sq/ m (with more than 1 million sq. m only in Bucharest). The stock has increased with 8 pct. compared to 2014, and in the end of the year could reach, according to estimations, to 2.35 million sq. m if all the announced projects will be delivered.

Apart from Bucharest, the developers of logistics and industrial spaces have also built projects in Timișoara, Ploiești, Cluj, Pitești, Sibiu, Arad and Oradea.

The take-up has totalized approx. 310,000 sq. m, compared to the level of 2014, with new contracts and expansions of 265,000 sq. m (+27%).

New request was 60 pct. bigger than the new offer, so the vacancy rate was diminished to less than 5 pct. in Bucharest and 10 pct outside Bucharest. (source: profit.ro)