"We are seeing a note of optimism in Europe regarding real estate financing projects, which is also found on the Romanian market. This is reflected in the approach of the banks in Romania, considering that the majority included in their strategy the financing of the real estate sector as a pillar of growth. However, there is a general concern caused by the high uncertainty in the political and economic environment that could have an impact on the development of real estate financing activities", said Ionut Măstăcăneanu, the coordinator of the KPMG financial services team consultant in Romania.

Europe's real estate markets have, over the last period, witnessed a stable level of lending activity, according to the 9th edition of the Barometer on Real Estate Lending. The study aims to evaluate the lending outlook of European markets and describe the attitude towards credit specific to each of these countries - Austria, Bulgaria, Croatia, Cyprus, Czech Republic, Hungary, Ireland, the Netherlands, Poland, Romania, Serbia, Slovakia, Slovenia and Sweden. The study was based on a survey of 70 bank representatives from the 14 countries included in the report.

"The total volume of investments in the first six months of this year declined by 19% compared with the first half of 2017, reaching almost 110 billion euros", the lowest level of the first semester of 2014 to date more likely because many of the transactions in the first half of the year are still unfinished, explains consultants.

According to them, markets in both regions are currently affected by similar factors, such as interest rates, which have fallen steadily in Central and Eastern Europe.

The respondents' replies to the preferred property classes indicate, however, that there are still key differences between Western European creditors compared to those in the developing CEE markets.

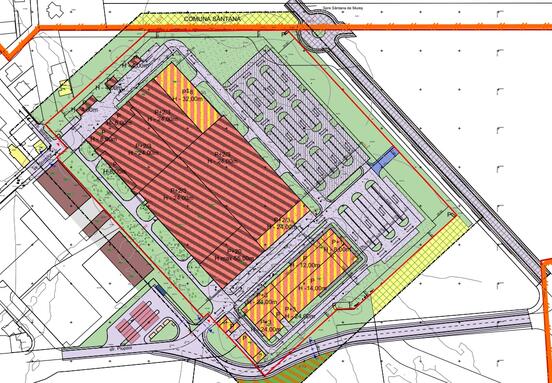

Residential properties are preferred by lenders in developed markets, such as the Netherlands, Austria or Ireland, according to respondents. Most ECE respondents have expressed their preference for the office segment, but the industrial and logistics class gains popularity, especially in countries such as the Czech Republic, Romania and Slovakia, as a result of the strong economic recovery in these markets in recent years.

Another good news is, according to the Barometer, that bad loans fall in number and value in Central and Eastern Europe. The proportion of performing loans, without delays in payment, in the portfolios of Central and Eastern European banks has become much higher, exceeding 85% in most countries. Romania is among the performers, with a 95% performance ratio. In comparison, four years ago, in only two countries, banks had over 85% of outstanding portfolio loans. (source: incont.ro)