In the previous year, there were only two transactions with areas of over 10,000 square meters, which totaled 35,000 square meters, which means that in 2019 spaces with a volume three times larger were traded.

On the other hand, there is a decrease in the segment of transactions with areas between 5,001 sqm and 10,000 sqm, from a total volume of 67,213 sqm, to 34,400 sqm.

"As in previous years, in 2019, the main driver of the office market was the IT&C, BPO and SSC companies. We estimate that the dynamism of these industries will be preserved in 2020, and the offer of approximately 300,000 sqm announced for this year will offer attractive relocation options to expanding companies, ”says Alexandru Petrescu, Managing Partner at ESOP Consulting l CORFAC International.

The segment of the middle sales, with office spaces with areas between 3,001 sq m and 5,000 sq m is close to the one of the previous year: ten transactions, with a total of 37,800 sq m, in 2019, compared to nine transactions in 2018, with a total of 38,100 sqm.

The oscillations were reported on the segments of the spaces for SMEs, with up to 250 employees. Thus, in the segment of spaces with areas between 1,001 and 3,000 sqm, the number of transactions decreased from 51, to 43, and the volume of traded spaces, from 83,480 sqm, to 72,260 sqm.

In contrast, the segment of office space leasing up to 1,000 sqm has grown: from 131 transactions, with a total of 53,724 sqm, in 2018, to 143 transactions, with a total of 60,210 sqm, in 2019.

In the segment of large office transactions, with an area of over 10,000 square meters, tenants came from only two sectors of activity: IT&C and Financial.

The share of IT&C companies is higher in the segment of transactions with very large areas, than in the whole market. The big tenants in the IT&C domain signed contracts for about 75% of the total volume of transactions over 10,000 sqm, the remaining 25% being occupied or reserved by companies in the financial field.

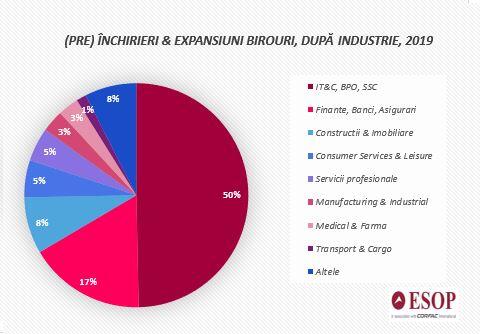

At the level of the entire office market in Bucharest, the domains are much more diversified, and the IT&C sector represents half of the total, secondly being the Finance, Banks and Insurance domain, with 17% , followed by Construction and Real Estate (which also includes operators of co-working office spaces), with 8%. (source: Esop)