The shift to remote or hybrid working has had a positive effect on the flexible office space segment in Romania over the last two years. Seen more as a trend of the moment than as a convenient alternative to traditional working environments, flexible offices have become an important tool and have attracted new clients from industries other than IT who have started to be interested in coworking and serviced offices. In addition, amid the conflict between Russia and Ukraine, some Ukrainian companies and freelancers have been looking to relocate to Romania, and flexible spaces have been an ideal option in this context. As a result, occupancy rates of flexible offices have increased, with some of the established locations in Bucharest recording an occupancy rate of 85-90% in 2022.

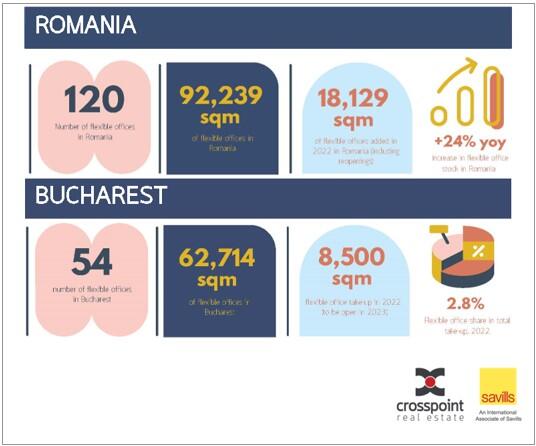

According to Crosspoint’s analysis, 21 new coworking centres and serviced office were opened in Romania in the post-pandemic period. In addition, three coworking hubs in Bucharest, Brașov and Oradea were reopened after having closed in 2020. In total, 18,129 sqm were added to the flexible office market in 2022, of which more than 11,000 sqm in Bucharest.

Bucharest hosts the most flexible offices in the country, but also the largest, with an average of 1.260, followed by Cluj-Napoca and Iași, where offices average 879 sqm and 529 sqm respectively. Coworking hubs remained the most widespread, but on average they occupy smaller areas than serviced offices – 470 sqm for coworking versus 1,708 sqm for a serviced office.

“Although the rates charged by operators have remained relatively unchanged compared to the beginning of 2020, the rapid increase in the inflation rate and reaching a record level for the last few years will affect the flexible office market. It is likely that in the coming period flexible space owners will have to adjust rates to align with new market costs.” says Ilinca Timofte, Head of Research, Crosspoint Real Estate.

According to DeskMag’s ”2022 Coworking Trends Survey” report, the number of centres making a profit globally has fallen considerably, with medium-sized operators (those with 2-4 locations) being least affected by the negative changes in the market. In addition, the Savills EME Investor Sentiment Survey Autumn 2022 shows that only 29% of investors would increase their exposure to flexible workspaces in the next 12 months.

Although the existing stock of flexible office space remains below pre-pandemic levels, both nationally and in Bucharest, the segment has an increased capacity to recover, due to the growing demand for such space. The last two years have highlighted the advantages and disadvantages of the flexible office market, which, while it can be a highly useful alternative to traditional offices, is very sensitive to change. Nevertheless, even in 2023 flexible offices remain a profitable business for experienced operators. In Bucharest alone, four new medium and large locations are expected to open, ranging from 1,000 sqm to 4,000 sqm.

If new entrants are now exploring new areas, experienced operators who have resisted an thrived in the current market conditions are expanding into regional markets and, in order to encourage collaboration and build communication and build communities, are offering office space free of charge. So innovative environments are replacing the traditional office with coworking camps in the heart of the nature, while large companies are choosing coworking for employees or collaborators working remotely.