Bucharest, Cluj and Timisoara are the towns where the office market is highly animated, fueled mainly by the stream of academically-qualified workforce graduating from the universities located in these cities. The IT and engineering sectors drive the employment market by absorbing almost all graduates of engineering &technical universities and, because their needs are numerous while the availability is scarce.

Tenants in BPO services turn to the graduates of foreign languages universities investing a lot in financial trainings required by the job description, as retention of personnel is the top priority of the HR departments’ agenda. As a reaction, the real estate market that has to accommodate companies in dedicated business services grows, too. However, even though demand increases, the educational system is unprepared to provide the required numbers of skilled graduates.

This issue may soon lead to a shortage of skilled manpower, which may in turn lead to a decrease in the number of new entry businesses incoming the market, which will undoubtedly affect the real-estate market.

A new pool of office developments in Bucharest is defined by the Orhideea district. This year 4 large developers - one of which is an experienced local, 2 Austrian and a Swedish company -, announced plans for 176,000 sq m in 4 projects to be delivered in the next 3 years. The total development value is estimated at 250 mil. Euro.

Floreasca – Barbu Vacarescu area remains on the top priority list with office building developments, attracting approx. 400 mil. Euro for the same period of time.

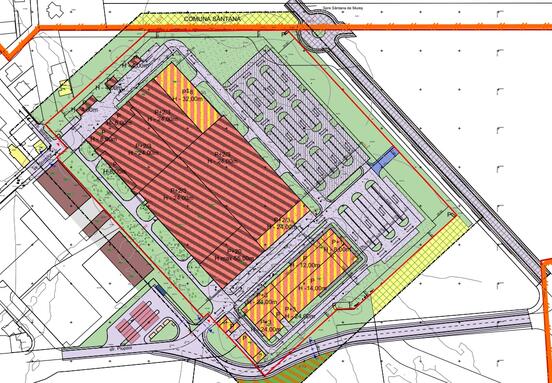

Industrial segment vacancy is defined by new regions in the country, still the hubs remain clustered around the Pitesti - Bucharest – Ploiesti triangle, although the West line created by the imaginary connection of Timisoara and Oradea or Brasov – Sibiu appear on the map of new products. The East side of the country, equally appealing, remains inaccessible, mainly due to the lack of the transport infrastructure.

Industrial segment is quite eye-catching, as per CBRE Romania representative, who made a nice overview of the last 5 years. During the crisis, the demand was small, not only in the number of transactions but also as regards the size required. The industrial segment is represented actively now, with the market growing organically since 2012, powered by services, retailers, producers and logistic operators. Transaction volumes cumulate approx. 250,000 sq m per year to date. 50% of the total transactions are in Bucharest.

The rest of 50% of transactions are taking place in the countryside. CBRE Romania estimates that at the end of 2015 the total area to be leased in Romania will reach 350,000 sq m. This seems to be a result of several years of hard working, rather than one time hit. If, in 2008 the duration of a transaction was of approx. 4 months, the last couple of years proved that a potential tenant could take up to 2 years to decide where they needed to be and how much they need to lease. It shows that business principles became more sophisticated, while planning, anticipating and healthy management lead to mature behavior.

North of Bucharest is currently under the interest of speculative industrial developments, for the first time in the last 8 years, and, as a result, the vacancy rate could rise up to 7 – 9% from the current 6%.

The total investment market in 2015 is estimated to achieve a value of approx. 800 mil Euro, affirms Colliers. At the same time the market seems to befall tide of mature products available for investors. This is a reason why new logistics & industrial developers are entering the market, while those on stand-by for the last 5 years are starting to develop their selective on- paper-office projects. The profile of the developers also needs to be considered. Some develop with a forecast to create an exit in 3 to 5 years and look for new development schemes for the meantime, while others develop to keep the properties part of their portfolios. PeliFilip, the law office with a high real estate expertise, represented as well in the panel of the discussion, mentioned a working list of 7 transactions between 40 to 100 mil. Euro, each. Encouraging news was presented by Colliers Romania, when they announced the pipeline of 4 transactions of over 100 mil. Euro.

The next couple of years will prepare the market for the maturity exam, postponed for so long, creating the chance for players outside the Central and Eastern Europe boarders, to consider Romania a mature productive field for their funds placement. It is also a chance, for the new generation of professionals in real estate to be part of a new age of transactions, a chance for which, the elders waited a good long time. (source: Nicoleta Radu, MRICS, Linkedin)