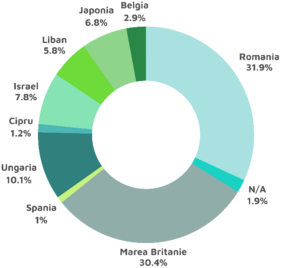

During this period, domestic capital generated transactions totalling EUR 163.5 million, representing 31.9% of the total investment market volume. The portfolio of acquisitions made by Romanian investors included office buildings, shopping centers, a hotel, and an industrial park, confirming a clear trend toward diversification of investment placements.

“Romanian capital is visibly maturing, and more and more entrepreneurs are choosing real estate investments for their stability, yield, and diversification. In 2025, we are seeing increasingly active participation from local investors in the office and retail segments,” said Nicolae Ciobanu, Managing Partner – Head of Advisory at Fortim Trusted Advisors, a member of the BNP Paribas Real Estate Alliance.

Major transactions by romanian investors

The largest acquisition by a Romanian investor in 2025 was the purchase of the Ethos House office building in Bucharest by Pavăl Holding, for EUR 24 million.

Other significant transactions, ranging between EUR 3 million and EUR 20 million, targeted office and retail properties in Bucharest and Romania’s main regional cities. Among these are CSDA Siriului and Pipera Business Tower (Bucharest), Ciolpani Commercial Complex, Winmarkt Someș (Cluj-Napoca), Hotel Balada Saturn, Casa Moșilor (Bucharest), and Fabrica in Timișoara.

Foreign investors: The United Kingdom and Hungary follow

The second place in the ranking of investor nationalities is held by the United Kingdom, with total transactions of EUR 156 million. All these acquisitions were made by M Core, which purchased seven retail parks located in medium-sized Romanian cities, as well as the Focșani Mall shopping center.

Hungary ranks third, with a total volume of EUR 52 million, represented by the acquisition of the Equilibrium 1 office building (20,700 sqm) by the company Granit.

Apart from these three countries, the Romanian market also attracted individual investments in 2025 from Japan, Spain, Israel, Lebanon, Cyprus, and Belgium, although with smaller volumes.

Evolution of romanian capital in the real estate market

The year 2025 marks a consolidation of domestic capital in the commercial real estate investment segment. However, the highest volume of Romanian investments was recorded in 2022, when Pavăl Holding acquired office buildings totalling EUR 467 million, representing 49% of the total transactions in what was a record year for the investment market.

About FORTIM Trusted Advisors, member an alliance of BNP Paribas Real Estate

FORTIM Trusted Advisors, member an alliance of the BNP Paribas Real Estate in Romania, is a real estate consulting company founded in 2002, managed by Costin Nistor, Bogdan Cange and Nicolae Ciobanu since December 2020. The company offers real estate consulting services in the office segment, retail, industrial & logistics, valuations, capital markets, research, but also Property Management and Project Management services. In the area of Property Management, the company manages over 100,000 square meters of office, retail, and industrial space.

Among the most important recurring clients of FORTIM Trusted Advisors are Morgan Stanley, Add Value Management, Indotek, Kesz and First Property Asset Management. Also, in the office segment, the company handled the trading of spaces for Reckit Benkiser, Renault, Fortech, Grohe, Credius, OLX Group, Multinode Network, AHI Carrier, AVL, UMT Software, Future Electronics, The Home or Bioderma.

Fortim Trusted Advisors provides services in sales, valuation, budgeting, market research, branding, and marketing for the residential sector, with Corallis being an example of a residential project for which they offer comprehensive consulting.