Offices dominate the deal flows with a 58% share, followed by a much slower retail sector with 18%, Industrial & Logistics (9%) and Hotels (8%), as shown by the latest report from the real estate consultancy company, Colliers International. In Romania, the investment volume was slightly below the EUR 0.5 billion threshold in the first three quarters of 2019,

Kevin Turpin, Regional Director of Research, CEE comments: “With the exception of the Czech Republic and Poland, most markets are down on Q1-Q3 volumes versus 2018 & 2017 respectively. However, with the fourth quarter of the year typically being the most active in terms of transaction closures, we expect the region to maintain a similar momentum to the previous 3 years and forecast a full year investment volume of between €12.5 and €13.5 billion.”

„If in Romania, at the beginning of the year, there seemed to be a good chance of crossing theEUR 1 billion threshold in terms of real estate marketliquidity, a large number of transactions were postponed for 2020. Thus, the volume for the whole year will be around EUR 0.6 -0.7 billion, the lowest value in the last 6 years. However, there is plenty of good news, because we have transactions with office buildings of about EUR 0.6 billion that could close in 2020, maybe in the first part of the year. Another positive aspect is that we’ve seen many new names this year, which is a good sign for future transactions and yields”, Mihai Patrulescu, Senior Associate Investment Services at Colliers International Romania, added.

Appetite from investors for all asset classes in CEE remains positive, particularly as a vast amount of capital is seeking allocation and the market fundamentals in the region remain compelling. A shortage of core and core plus product can be found in some markets and sectors, as many of such properties are in the hands of long-term holders, portfolios and platforms. In addition, some owners may be hesitant to sell without the opportunity for redeploying their capital.

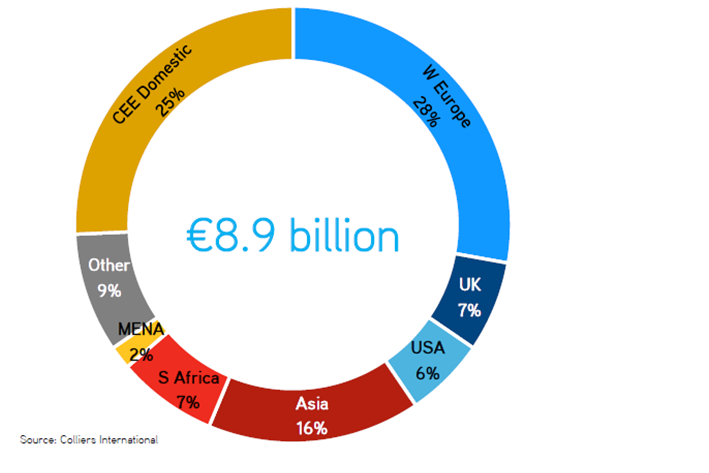

As a result, many investors are looking at different strategies such as value-add and opportunistic plays, plus considering alternative sectors such as student housing, healthcare, private rental (residential), amongst others, although these are still in a relative early phase in terms of availability. More than 50% of capital deployed in the first three quarters of 2019 has come from continental Europe (including CEE), with 25% of the total volume coming from CEE investors alone. Asian Capital, particularly from South Korea, has also been active with a share of around 16%.

Prime yields across all countries and sectors are below, or close to, previous historical lows (pre-great financial crisis). Despite the 375bps spread between Sofia (8.0%) and Prague (4.25%) on prime offices, there is a further spread to similar product in Germany (3.0%) and to other, perceived, more risk averse investment vehicles, such as government bonds. Further yield compression should be limited, with a few exceptions as highlighted in the report. (source: Colliers)