The net take-up, excluding renegotiations and renewals of existing contracts, had a share of only 46% in the total leased volume in Q4 and 44% across 2023. As a result, companies leased new offices for at least 20,000 extra employees, primarily working in the IT&C, manufacturing, financial, retail and medical sectors.

The Cushman & Wakefield Echinox office agency was the market leader in Bucharest, closing transactions totaling 104,000 sq. m in 2023, having a share of 25.5% in the volume brokered by real estate agents. Moreover, the office team oversaw leasing transactions of more than 250,000 sq. m in the past 3 years in Bucharest.

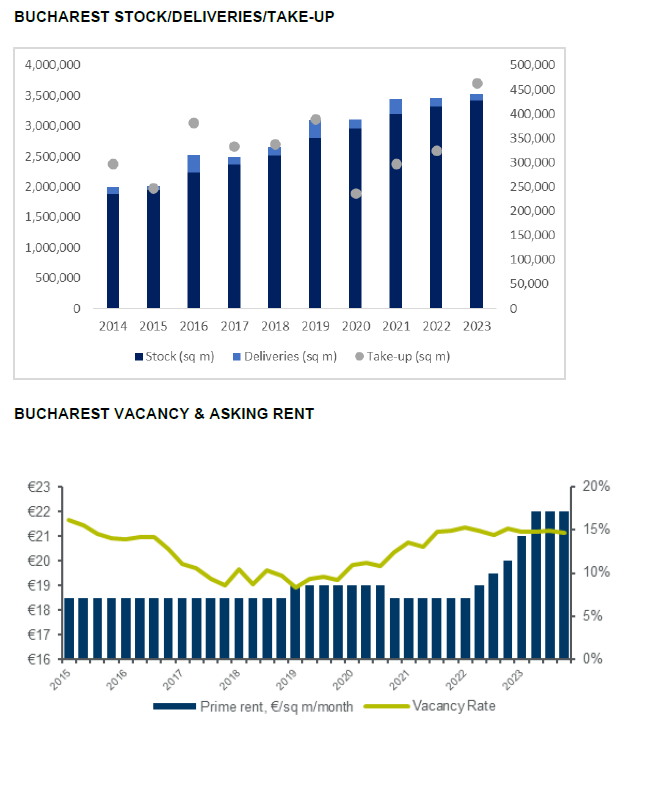

Arghezi 4 (8,000 sq. m GLA) was the only office project delivered in Bucharest in Q4, thus bringing the total 2023 new supply to 110,500 sq. m, the lowest level since 2015.

The Bucharest office stock stands at around 3.4 million sq. m, with the pipeline being very low, as only 2 projects are currently under construction (amounting to 42,500 sq. m GLA), as a direct consequence of the ongoing urbanistic/permitting issues.

Only one new building is due to be delivered in 2024, namely AFI Loft (15,000 sq. m), the new supply for this year thus being at an all-time low.

The (contractual) vacancy rate of office spaces stands at 14.7%, down from 15.2% at the end of 2022. The vacancy rate should remain on this downward trend, especially when considering the uncertainties regarding the delivery of new projects, and mainly in buildings located in ultra-central and central locations.

Mădălina Cojocaru, Partner Office Agency Cushman & Wakefield Echinox: “While analyzing the office leasing market in the past 3 years, we noticed that more than 1 million sq. m of such spaces were transacted in Bucharest, representing approximately 33% of the total stock. This volume was practically recorded in a period characterized by new market fundamentals, where companies configured their strategies concerning their office space needs. This led to a downsizing of occupied areas for some tenants, but also to keeping or even expanding the leased spaces in the case of most occupants. We have also seen that close attention is being paid to the overall quality of office spaces, making the buildings located centrally and ultra-centrally, with access to public transportation and those that meet the ESG standards, more attractive to tenants and having the highest asking rents on the market.”